What is a stablecoin?

The Origin of Stablecoins

With the rise of cryptocurrencies, an increasing number of investors and institutions have entered the world of digital currencies. In this highly volatile market, where fiat currency conversion might not always be timely, most investors still require a virtual currency on trading platforms that serves as a "fiat-like" option. This ensures they can instantly meet their hedging or arbitrage needs.

Type of stablecoins

While there are hundreds of different, patented stablecoins in use right now, there are four main "types:"

-

Reserved based on the U.S. dollar or other fiat currency (Tether)

-

Collateralized by another crypto, like Bitcoin

-

Backed by a commodity like gold

-

Modified by a smart contract algorithm - This technology utilizes a smart contract on a decentralized (blockchain) platform (usually Ethereum) and will run automatically to keep the coin stable. This is very similar to when central banks print banknotes to maintain valuations in fiat currencies. These tokens don't have any reserves that the stablecoin is backed off of, but instead, the investors monitor the mechanism to watch it maintain stability.

Common Stablecoins

- USDT - USDT is a stablecoin issued by the American company Tether. It is a fiat-backed stablecoin and is currently the most widely circulated and used stablecoin. It is pegged 1:1 to the US dollar. However, due to the company's reluctance to disclose its audit reports, its transparency is questionable. Many stablecoins have attempted to replace USDT, but since Tether entered the market very early, it remains the most circulated stablecoin and is difficult to replace.

- USDC - USDC is developed by Coinbase and Circle companies. It is a fiat-backed stablecoin anchored 1:1 to the US dollar. Circle is a company under the Goldman Sachs Group, holds licenses, and is regulated by financial institutions and the law, making it more transparent than USDT. Currently, USDC is the second most circulated stablecoin after USDT.

- DAI - DAI is a stablecoin introduced by a decentralized organization called MAKER DAO. It is pegged 1:1 to the US dollar and belongs to the over-collateralized type. MAKER DAO deploys smart contracts on Ethereum, issuing DAI by collateralizing ETH and maintaining the exchange rate with the US dollar by adjusting the collateral interest rates.

Issues with Tether (USDT)

Generally, the concept of stablecoins entails maintaining a 1:1 value with the US dollar. In other words, if I issue 1 million US dollar-pegged stablecoins, I must hold 1 million US dollars to ensure that users have sufficient reserves when converting to fiat currency. This is the fundamental concept behind stablecoins.

In 2014, the first stablecoin, Tether (USDT), was introduced, bridging the gap between real fiat and cryptocurrencies, while also energizing the entire cryptocurrency market. To this day, USDT remains the dominant stablecoin, holding 80% of the market's total value in stablecoins, with trading volume consistently above 90%. However, doubts about USDT in the market have never ceased.

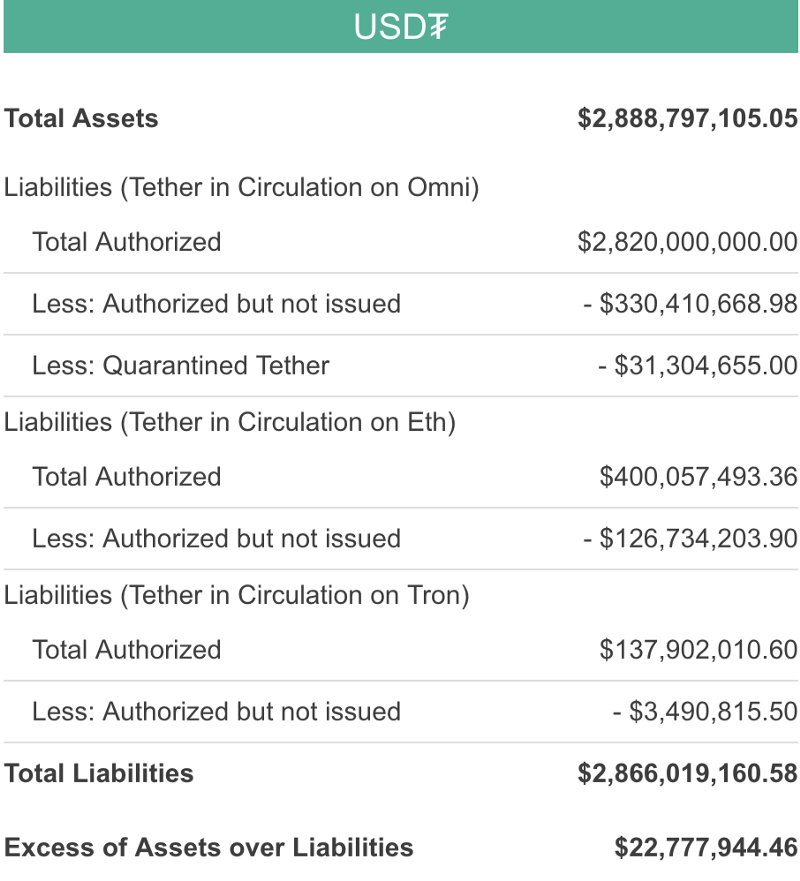

Source: Tether Current Balances

According to the previously mentioned concept of stablecoins, for Tether to issue more USDT, they must back it with an equivalent value of US dollar reserves. As long as the company can prove that it has an adequate amount of US dollars as collateral, users can confidently use USDT as a virtual substitute for the US dollar.

However, here's the problem: who can prove that Tether has the corresponding US dollar reserves? And do the individuals providing this proof of USDT's collateralization have credibility?

The Essence of Currency is Trust

We use official currencies such as the New Taiwan Dollar and the US Dollar as a means to store value because we trust that these fiat currencies are issued by governments.

The essence of stablecoins is no different. If everyone believes that USDT is sound, there will be arbitrage opportunities for those who buy when the USDT value falls below 1. Therefore, significant decoupling is unlikely to occur in the short term if trust in USDT remains strong.

What can you do with stablecoins?

Minimize volatility. The value of cryptocurrencies like Bitcoin and Ether fluctuates a lot --- sometimes by the minute. An asset that's pegged to a more stable currency can give buyers and sellers certainty that the value of their tokens won't rise or crash unpredictably in the near future.

Trade or save assets. You don't need a bank account to hold stablecoins, and they're easy to transfer. Stablecoins' value can be sent easily around the globe, including to places where the U.S. dollar may be hard to obtain or where the local currency is unstable.

Earn interest There are easy ways to earn interest (typically higher than what a bank would offer) on a stablecoin investment.

Transfer money cheaply. People have sent as much as a million dollars worth of USDC with transfer fees of less than a dollar.

Send internationally. Fast processing and low transaction fees make stablecoins like USDC a good choice for sending money anywhere in the world.